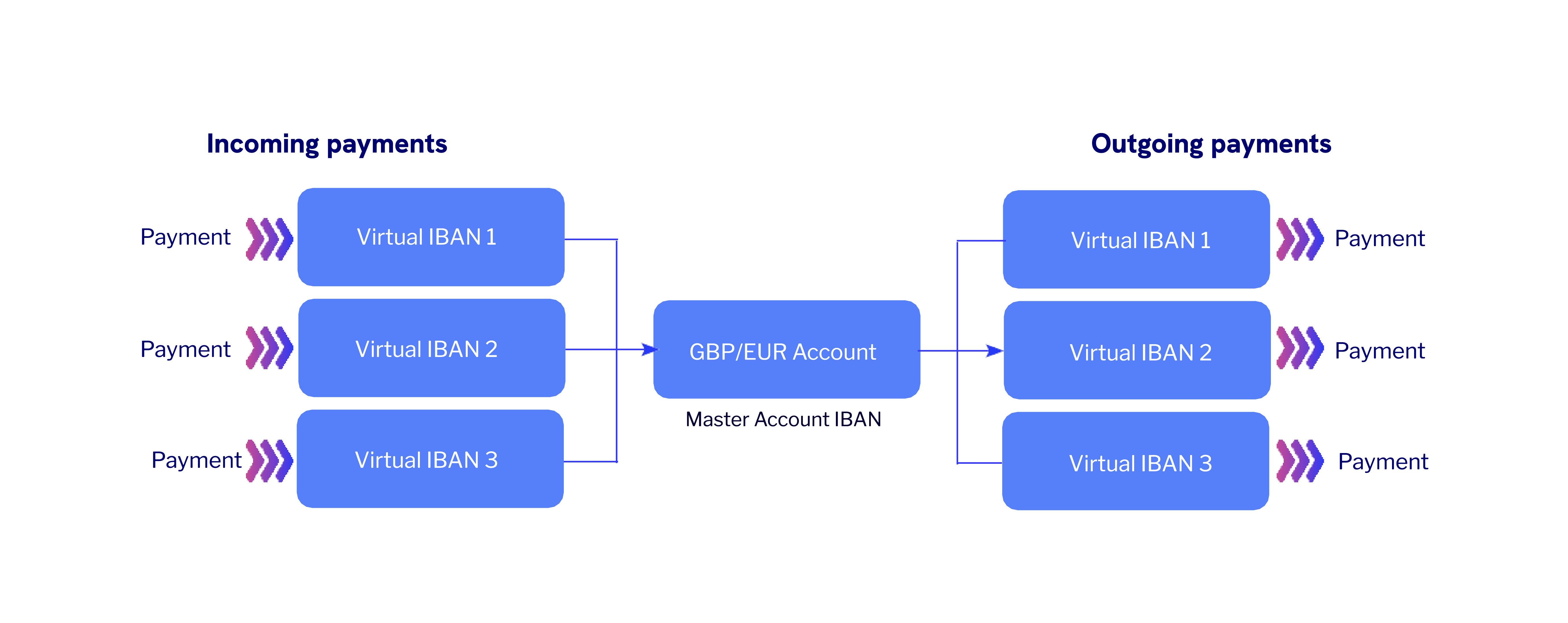

Allocate client money accurately

Reduce payment rejection rates from error-prone payment references

Compliance and anti-money laundering challenges are reduced, through clear segregation and improved transparency of funds.

Our vIBANs cut costs and complexity, giving businesses time back to focus on strategic goals and other vital corporate tasks.

Enhancement of security through account privacy and reduction of manual processing.

Compliance and anti-money laundering challenges are reduced, through clear segregation and improved transparency of funds.

Our vIBANs cut costs and complexity, giving businesses time back to focus on strategic goals and other vital corporate tasks.

Enhancement of security through account privacy and reduction of manual processing.

To find out more about using virtual IBANs speak to your BCB customer service representative or contact us today.